If I had to pick one thing that has been annoying me most about our President's speeches recently, it would have to be his use of classist rhetoric to blame our government's economic failings on the wealthy in our country. Last night's State of the Union, to no one's surprise, included his tagline complaint that some aren't "paying their fair share". Although on the surface it should be obvious that there is no logical reason to believe this anti-rich rhetoric, it hasn't stopped a lot of people from doing exactly that, so I decided to look into it a little more depth. In all reality, all of President Obama's anti-"rich" tax speech can be boiled down to two questions.

1- Who are the "rich" in our society? and 2- Do they pay their "fair share"?

1- The first question has had a few different answers over the past few years, but the only answer that matters right now is what the president thinks "rich" means. President Obama has been calling for a tax increase on all families making over $250,000 a year and an even more significant increase on people earning over $1,000,000 a year. The president has said this would leave taxes the same for 99% of families. Unfortunately, that's just false. $250,000 a year may sound like a lot to you or me, but it doesn't put you in the top 1% of taxpayers. It takes an annual income of $380,354 to be one of top top 1% (or $343,927 depending on the recent year of IRS stats you use). It used to be quite a bit higher before the recession hit hard, in 2007 it was $424,413, but it has been on the decline while the economy suffers. So here's my first big issue with the President's rhetoric: It's founded on one blatant lie and one implied one. The first is that it will only affect the top 1% of taxpayers, which as you can see is just not true. Are these people still in the highest brackets of income? Yes, but the impact of the tax increases will not be not near as isolated as the President tries to make it sound. The second, more subtle, lie is that the "rich" have not been affected by the tough times our country is going through and therefore can afford to pay more taxes while the rest of us are suffering. That's also clearly false, as is evidenced by the drastic decline in the amount of earnings it takes to be in the top 1%. There's also the underlying concern I have with saying that anyone that makes more than $250,000 a year is rich. You and I all know people, probably a lot of them, that make more than that and most of them don't qualify as rich in my book. They don't own private planes, drive Lamborghinis, or have a vacation house on the beach. Depending on where you live, $250,000 a year might not even cover a nicer than average house. The $250,000+ a year is a category that a lot of your friends may fall into. Many small business owners, attorneys, physicians, realtors, and other professionals may be in this income category. These people make a good living, but they're not isolated from the effects of a bad economy and they still have to go to work to make ends meet. They're not sitting around counting their money or living purely off investments, they put years into building their businesses and practices to make a good living and presumably work hard for their money. More importantly is that these are the people that hire the rest of us. They invest in their businesses and by doing so allow many of us to earn a paycheck. If we increase their taxes, do you honestly believe that is going to help create more jobs? Even if we only increased the taxes on the "wealthy" that make millions a year and are job creators on a much larger scale, the logic still stands: Business owners don't hire more people when you take more of their money away each year. Since many people agree that the most important part of getting our economy back on track is getting people back to work, why are we suddenly attacking these people as not paying their fair share?

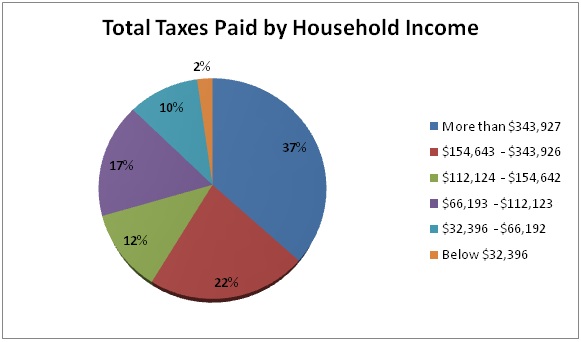

2- Is it because there is some truth to the President's claim that they aren't paying their fair share? He has been quite willing to have Warren Buffett, one the wealthiest men in the world, use the media as a way to promote the "rich should pay more" message and build resentment against the "rich" that disagree with his view. If Mr. Buffett thinks the rich should pay more taxes those that say they already pay their fair share are just being greedy, right? Surely one of the wealthiest men in the U.S. wouldn't be offering to pay more taxes if there wasn't some system in place favoring the "rich" Obama is rallying against, correct? Wrong. Warren Buffett is the third richest man in the world with a net worth of $50 billion dollars. In 2010, he made nearly $63 million in income. He has said in the past his effective tax rate is around 19% and that he should pay more taxes. His lower tax rate, much like Mitt Romney's, is because his income doesn't come from a paycheck each year like most Americans, or even most of those earnign over $250,000 a year, but from investments. This is the first critical point that people need to understand- increasing income taxes won't affect Warren Buffett, Bill Gates, or even Mitt Romney much at all, it will just hurt those that rely on paychecks to make a living. So why is President Obama using Warren Buffett to justify increases in income taxes? Well... I don't know of any reason that doesn't assume we're idiots or have purely political motives. But even if the tax increases were going to affect him, Warren Buffett has as little in common with someone earning $250,000 a year as a person earning $250,000 a year does with a homeless person. His annual income is 252 times that of what President Obama is classifying as rich. To put that in context, the family earning $250,000 a year makes five times the average household income of $50,221. Who do you think they feel closest to on the income scale- Mr. Buffett or the average family? To answer this "are they paying their fair share" question though we need to use some real numbers, not fight rhetoric with rhetoric, so here goes... In 2009, the top 50% of Americans, those earning over $32,396 a year paid 97.75% of ALL taxes. The top 10%, (>$112,124) paid 70.47% of all taxes. The top 5% (>$154,643) paid 58.66% of all taxes, and the top 1% (>$343,927) paid 36.73% of ALL taxes. So if you earned between $32,396 and $112,124, you make up 40% of Americans that pay 27% of all taxes. If you made less, you make up 50% of all Americans that pay 2.25% of all taxes. For the graph lovers among us, here's a pie chart:

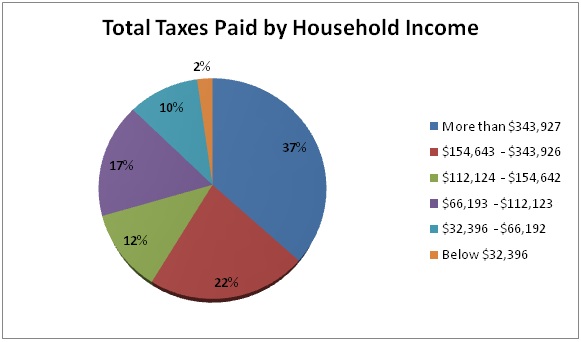

So there you have it, a total breakdown of who pays the bulk of the taxes under current laws. The top 1% of people pay 37% of all our country's taxes, and the top 5% pay nearly 60% of all the taxes each year. But is what they're paying "fair"? That's a much more difficult question that has no objective answer, so I'll turn to historical data to give us a better idea of what these people have paid over time. Below is a chart showing the effective household tax rates for the past 30 years:

As you can see, the highest earners have seen a mild drop in total taxes when compared to 1979 numbers, but they have not enjoyed as much of a drop in effective tax rates as any of the other quintiles over the past 30 years. Yet they're the ones being targeted. If anything, the nearly half of Americans who pay no net income taxes should look up the definition of the word "fair" in the dictionary before complaining about how much the rich pay. The highest earners pay the highest effective tax rates among American families and pay over half of all our country's tax income. So what gives?

If the President wants to increase taxes on the rich (a mistake, in my opinion), he shouldn't be doing it on the premise that they're not paying their fair share or are somehow eluding paying their taxes- the numbers clearly show they pay more taxes than the rest of us combined and have the highest effective tax rates. He also shouldn't be using billionaires who don't pay any significant amount of income taxes to justify raising taxes on those that do rely on a paycheck for a living. Investment income and paycheck income aren't taxed the same (the theory has always been that we like to encourage people to invest their money, not punish them), so why are Mr. Buffett and President Obama pushing these proposed increases on the working "rich" who pay income taxes using investment income as the example? If someone as unimportant as me can demonstrate his premise to be wrong, then imagine what his political opponents can do. Call it what it is- a "we're broke so we're going to punish the people that make the most money to pay for our lack of budget skills" tax increase. The use of anti-rich rhetoric and playing off the sympathies for the Occupy Wall Street movement is nothing more than an attempt to incite class warfare in an election year and the Obama campaign team knows it. The populist tone has been a theme of the campaign from day one, but at least it was based on happy, if somewhat empty, ideas like "hope" and "change". Now that they need someone to blame for the mess they and their predecessors have gotten our country into, they've decided to pick up their pitchforks and torches and go after the so-called rich under the illusion that it's somehow partly their fault because they're not paying enough right now. If the President thinks punishing the people that generally hire the rest of us and stimulate the economy is the best way to pay for our country's irresponsible amount of debt, so be it, but let's not pretend it's because they're not paying their fair share.

-Matt

All tax data used in this post comes from the Internal Revenue Service. If you'd like to look at some of the data yourself, the IRS and the Tax Policy Center are good resources.

No comments:

Post a Comment